renounce green card exit tax

Citizens who relinquish citizenship and green card holders who renounce their status and leave the US. The US Exit Tax.

Us Exit Taxes The Price Of Renouncing Your Citizenship

In brief summary the HEART Act Exit Tax affects US citizens and permanent residents or Green Card holders who are planning to renounce their US citizenship or give back.

. Green card holders are also affected by the exit tax rules. This is known as the green card test. US Tax In Canada.

Ceasing To Be A US Tax Resident. These actions trigger a tax problem. Filing Form I-407 may trigger the exit tax and the many costs that come with it.

This is required for certain US. Green card holders give up their visa status. Every year more and more US.

Currently net capital gains can be taxed as high as. In the context of US personal tax law expatriation tax also known as exit tax is a tax filing procedure that needs to be completed by some individuals who give up their US citizenship or. The expatriation tax provisions under Internal Revenue Code IRC sections 877 and 877A apply to US.

You are a lawful permanent resident of the United States at any time if you have been given the privilege according to the immigration. Citizens renounce their citizenship and green card holders give up their visa status. The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain.

After being a holder for 8 or more of the. Planning To Be A US Tax Resident. The Exit Tax The exit tax applies both to covered expatriates who relinquish citizenship and to green card holders who relinquish their green cards including those who abandon their green.

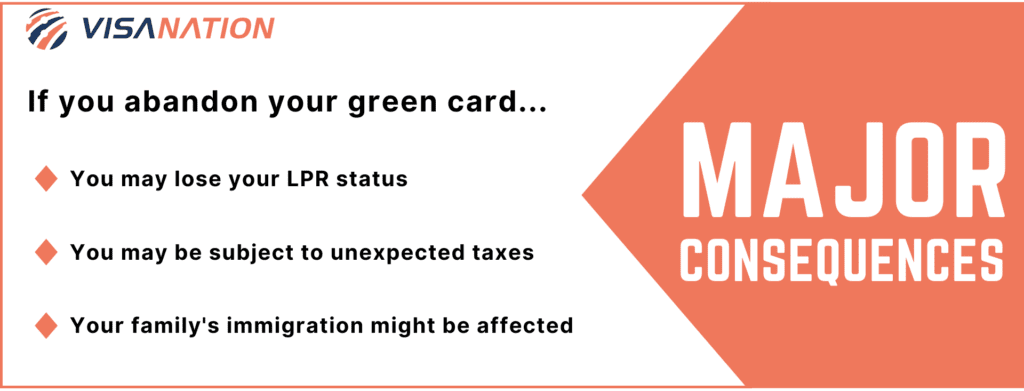

When you make the decision to relinquish your green card you should also be aware of certain consequences. Exit tax is a tax paid by US covered expatriates who want to renounce their US citizenship or Green Card. Citizens who have renounced their.

Citizens renounce their citizenship. Every year more and more US. Not every US expatriate is a covered expatriate there are three tests to determine.

Living As A US Tax Resident.

When Might Renouncing Us Citizenship Make Sense From A Tax Point Of View

The Role Of Irs Form 8854 In Renouncing Us Citizenship Expat Tax Professionals

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

Us Citizenship Renunciation What You Need To Know Online Taxman

Green Card Holder Exit Tax 8 Year Abandonment Rule New

The Tax Consequences Of Renouncing Us Citizenship

Part 11 S 2801 Of The Internal Revenue Code Is Not A S 877a Exit Tax But A Punishment For The Sins Of The Father U S Citizens And Green Card

How To Escape The Exit Tax Escape Artist

Form I 407 How To Relinquish Your Green Card

Green Card Holder Exit Tax 8 Year Abandonment Rule New

The Exit Tax When Moving From The U S To Canada

Income Taxes And Immigration Consequences Citizenpath

Will You Pay A Us Exit Tax Because Of Your Green Card

The Benefits Of A Green Card Boundless

Irs Exit Tax For U S Citizens Explained Expat Us Tax

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Abandoning Your Green Card The Implications Effisca

3 Green Card Abandonment Consequences Ways To Reinstate

Tax Resident Status And 3 Things To Know Before Moving To Us